Applied Materials (AMAT) is surging higher today to a new 5 year high after it was announced it would merge with another global giant, Tokyo Electron Limited, in an all stock transaction valuing the new company at nearly 30 billion. The merger brings together complementary technologies in the semiconductor and display markets and is expected to close in about a year. After the close, Applied Materials shareholders will own approximately 68% of the new company and Tokyo Electron shareholders approximately 32%. The combined company will have a new name, but dual HQ’s and a dual listing on the Tokyo Exchange as well as the Nasdaq.

Tetsuro Higashi, Chairman, President and CEO of Tokyo Electron, said, “Today, we are launching a new company and taking a bold step forward for our industry. Built on a foundation of people, technology and commitment, we are creating a truly global company that we believe will expand the value we deliver to our customers and be able to achieve new levels of financial performance.”

Gary Dickerson, President and CEO of Applied Materials, said, “We are creating a global innovator in precision materials engineering and patterning that provides our new company with significant opportunities to solve our customers’ high-value problems better, faster and at lower cost. We believe the combination will accelerate our momentum for profitable growth, increase the value we deliver to shareholders and create great opportunities for our employees.”

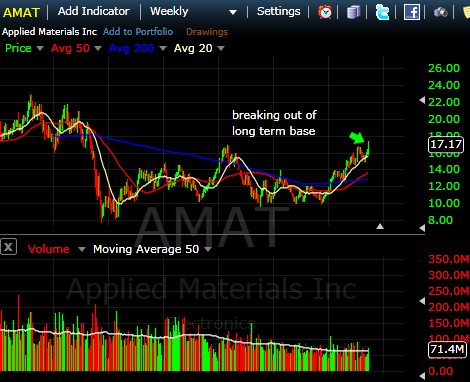

As mentioned above, AMAT is looking quite bullish and breaking out to a multi year high today. It probably needs to spend a few weeks digesting gains at some point soon, but AMAT appears to be a solid long term play.

You can get a free daily technical analysis “analysis” of AMAT for free here! Don’t miss it.