It’s been quite awhile since I’ve posted here, but hope to be more consistent with profitable stock trade ideas! With today’s post I highlight the first of 3 biotech stocks that IPO’d this year and are flashing big, high volume breakouts. Please know that biotech stocks carry considerably more risk than just about any other industry. They live and die by results of drug trials and any negative result can send the stock diving. Do your due diligence on these and in my opinion, never place large bets on these. With that being said here is the first small biotech play showing tremendous momentum with a couple more to come over the next 24 hrs.

Enanta Pharma (ENTA) is a small pharma company with a focus on infectious diseases and specifically, helping to find better a treatment of hepatitis C. Here’s a recent write up from Motley Fool:

“Expiration of lock-up periods after a company goes public sometimes has insiders selling shares in mass — driving the stock down. Although the lock-up period expired for Enanta Pharmaceuticals (NASDAQ: ENTA ) this week, there certainly was no sell-off. Actually, the opposite occurred, with the stock soaring 31%.

Enanta went public back in March. Rule 144 of the Securities Act of 1933 places restrictions on insider selling until at least six months after the new security is issued. This lock-up period fell by the wayside on Tuesday. Shares of Enanta promptly went on a nice run that continued through the week.

The biotech is in partnership with AbbVie (NYSE: ABBV ) to develop protease inhibitors to fight hepatitis-C. Experimental drug ABT-450 is in a phase 3 study and was granted Breakthrough Therapy designation by the U.S. Food and Drug Administration in May. The all-oral antiviral combo from AbbVie and Enanta is considered to be one of the top prospects for treating hepatitis-C, which affects around 3.2 million Americans.”

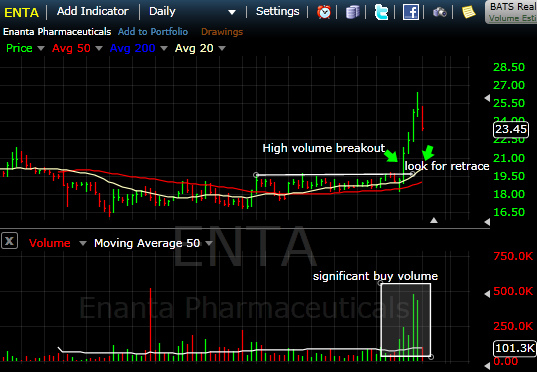

Technically, the stock is extremely bullish as indicated by the high volume breakout from a base in the chart below. This is what I would call more of a saucer base (a very shallow cup with handle base) which can actually be considerably more bullish than a standard cup with handle base. The stock broke out of the handle formation at around $20/share about one week ago with heavy volume. This presented the first opportunity to enter the trade, but about 75% of breakout stocks provide a 2nd chance opportunity on a retracement of the breakout move. In order to minimize risk, you want to enter the trade as close to the breakout point around $20 as possible, but I see an ideal entry all the way up to $21 – $22 should it return to that level (I think it will).

===> Be sure to get your Free ENTA Daily Technical Analysis Here