Well it’s been a long time once again since I’ve posted here so realistically consistent posting probably isn’t going to happen. All my time these days is spent with Bumblejax which has been a terrific journey and remains my passion, but I miss the stock analysis and trading which I have only dabbled in the past few years. However, the decision to step away from the market was the best decision ever for both my mental and physical health. Being on the West Coast I can’t say I miss the 5:30AM alarm clock to get ready for the market day or the constant pressure and long hours to make sure I was providing the best information to my members at Self Investors in a timely fashion. In a nutshell, doing that for 6 years burned me out.

I will always be fascinated by the market and the opportunities it presents. I love researching new companies breaking out of bases for the first time following an IPO (which by the way, is often the most significant and potentially rewarding trade setup there is). The heart and soul of my strategy remains within an analysis of the stock chart which provides a picture of supply and demand. With that said, a lot can be learned by reviewing past stock picks to see how things panned out. At the end of the article I’ll provide a new momentum stock play to keep an eye on in the hottest sector right now.

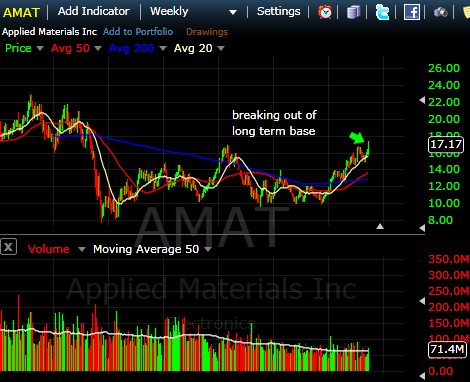

First up is Applied Materials (AMAT) which I wrote about in Sept of last year as it was breaking out of a double bottom base (albeit, not a perfect one) at just above $17. Here was the chart at the time:

Now let’s take a look at the current chart to see how it fared. You can see in the chart below it’s been a methodical, steady move up of a bit less than 10%. Not bad, but not impressive. Exactly what you’d expect from a big market cap stock in a rising market. The real gains are seen in small to mid caps which you’ll see below.

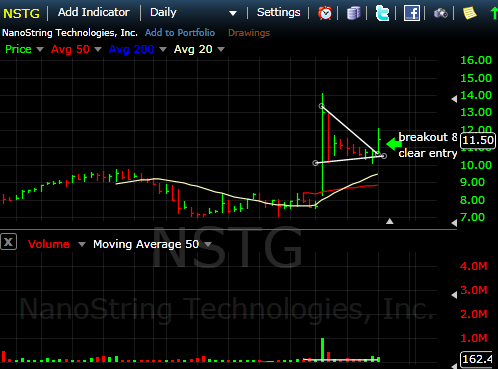

The last round of breakout stocks I highlighted were in the biotech space which at the time was on fire. That’s the key, find stocks breaking out in sectors that are catching fire across the board and your chances of success skyrocket. Let’s take a look at NSTG. When I highlighted it in September of last year it had just broken out of a picture perfect pennant formation .. an absolute beautiful setup for another run higher.

Take a look at the run from that breakout. Granted, this took a bit of time to get going, but once it did it really got going! So here’s a key moment in this trade which took place at the end of October. See how the stock continued drifting down consolidating the big gain in September? Had you got in during the breakout when I highlighted it at around 11.50, you’d be down a fair amount at that point and a bit nervous about holding right? You and quite a few others. Look how the stock shook out nervous traders, but finished the day near the top of the range which was the moment the stock more than doubled in price. Reversal moves like that where the stock sells off sharply in the 1st half of the trading day only to recover and close near the top of the trading range is always bullish. It’s a capitulation move.

This is a great example that highlights some important lessons. Lesson #1 – Do Not Enter the Entire Position Right Away. Particularly with highly risky biotech stocks, you want to scale in slowly. For these kinds of stocks I would typically start small with 2.5 % of the total portfolio. This will limit the need to have a finger on the sell trigger at all times and give the stock a chance to breathe and do its thing which hopefully more often than not is up. In this case that last dip at the end of October didn’t take out the huge breakout point in early September. That breakout remained technically intact. As it turned out this stock just needed more time to digest that huge gain which brings me to Lesson #2 – The Greater The Breakout Move, The Longer The Consolidation. In this case, where I highlighted that pennant, the stock had only spent a few days consolidating that massive gain making the odds greater that it needed more time. It doesn’t mean you can’t get in there, it just means you need to be sure to scale in slowly and give it time if it needs it. The next breakout point in this stock was actually right out of a cup with handle type setup on Dec 6th above $13. You could have added your 2nd position (I like to add another 2.5% of total portfolio value).

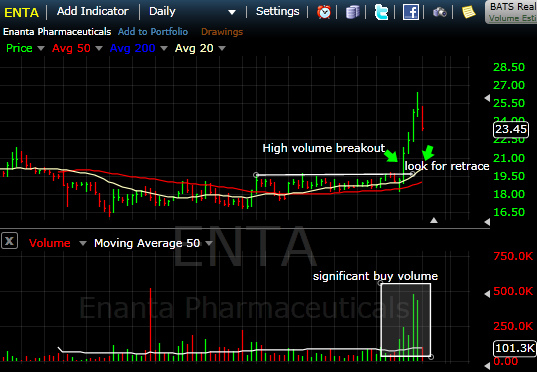

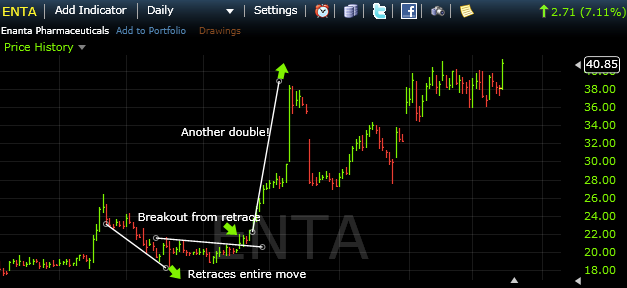

Ok let’s take a look at the next biotech breakout stock ENTA which I highlighted around the same time in Sept ’13. This was a stock I needed to see consolidate a big breakout move that had taken place. The 1st entry point in this stock was out of that flat base around $20. You could have scaled into it with a 1st position at that point. If you missed the initial breakout, no worries there are almost always 2nd chances which brings me to Lesson #3 – Breakouts Always Retrace. What I mean by that is that in almost all cases a stock that breaks out will retrace at least half of the breakout move and often times the entire breakout move to the original breakout point.

A current chart helps to explain this concept better. See how this stock retraced the ENTIRE move and offered a 2nd chance? This brings me to LESSON #4 – NEVER Chase A Breakout. If you don’t get in on the breakout within 5% or less of the breakout point, let it go to minimize risk. You want to catch them as close to the breakout point as possible. If it gets away from you no problem! Almost all stocks will provide a 2nd chance as this one did. Two opportunities to capture a double on your investment in just a couple weeks. Not too shabby.

DISCLAIMER: Now would be a good time to remind you that the results of these two biotech plays are not typical! I know you know that but for someone new to trading, it’s worth repeating. These two happened to work out extremely well. Not all do which is why it’s important to scale in with a small position and exit if the initial breakout point is broken. You can be right less than half the time and still do extremely well if you hit on a few of these and minimize losses. Trading is all about minimizing risk and maximizing potential reward. The lessons above will do that and tip the odds in your favor.

Tesla Motors (TSLA) is another stock highlighted here in 2013, but I won’t get into the details of the chart of Tesla Motors (TSLA) in this post. I think my original post covered it fairly well and you can look for similarities to the charts above. Take a look at the 1st and 2nd chance it offered around $40/share in April 2013 before going onto more than a 600% gain in less than a year. A new company, disrupting a long established industry breaking to new all time highs is always an extremely bullish sign and a chance at significant profit. In this case extraordinary profit. Even at $250 TSLA’s chart still look very healthy, but needs quite a bit of consolidation time. No it’s not a good place to get into TSLA for the first time.

The Action Right Now Is In Metals

I’d like to wrap up this post with LESSON #5 – 70% of Stocks Move In Direction Of General Market, so it gets a bit riskier up here as the overall market remains at overextended levels with some recent selling pressure. For that reason it’s even more important to choose a sector that is heating up. One such sector are the metal plays with significant breakouts off the bottom in gold and silver playing out over the past few weeks. The leading metal plays have already had healthy runs, but there are still opportunities. When I first highlighted those biotech plays, the biotech stocks had already been heating up for a few weeks and they remained on fire for several months. This run in metals could last awhile.

So a bit of a disclaimer on these metal play breakout plays. They are quite speculative lower priced stocks with greater risk, but greater reward as well. Same rule applies. Scale in with an initial smaller position.

Go here to see the first momentum metal play! This stock soared from just over a buck to over $19/share in about a 9 months span in 2007. Will it make a similar move?